FRACTIONAL ART OWNERSHIP

THE BACKGROUND

Fractional art ownership opens up the opportunity to own and trade “shares” of fine art masterpieces in a regulated and transparent marketplace. With the expertise of Artemundi, this model has become an attractive alternative investment available to accredited investors and permissioned markets through various providers.

Our collaboration with the Swiss company Splint Invest, adhering to Finma regulations, enables European investors to purchase and own fractions of artworks, referred to as “splints,” starting from 50 EUR on their platform. This offering is available in permissioned markets.

In a groundbreaking move in 2021, Artemundi, in partnership with Sygnum Bank, fractionalized Picasso’s Fillette au béret painting. This marked the first time that ownership rights in a Picasso, or any artwork, were recorded on the public blockchain by a regulated bank. Accredited investors can now buy and trade “digital shares” in the artworks. Please note that this product is exclusively available for accredited investors.

Artemundi plays a pivotal role in facilitating access to digital marketplaces and reducing entry barriers to the art market. Operating under Swiss banking regulations, both institutional and private investors have the opportunity to buy, sell, or trade fractionalized ownership of blue-chip artworks.

If you’re not in Europe, sign up and stay tuned! Products for other countries coming soon.

Why is fractional ownership possible today?

- Technology allows direct ownership.

- Technology transforms art into bank-grade securities on the blockchain.

- Technology allows fractionalization of the asset for diversification.

- Technology allows liquidity on secondary exchanges.

- Technology makes the underwriting, ownership, and tradability direct, safe, and accessible with the click of a button.

- Technology significantly reduces cost and counter-party risk by providing peer-to-peer transactions between buyers and sellers.

- Technology and smart contracts “if > then”, implement commands or instructions instantly, without the possibility of human error.

Why Splint Invest?

- Trust.

- Expertise: Splint Invest is a pioneer in fractional ownership of different alternative investment assets.

- True democratization and accessibility to alternative investments.

Why Sygnum Bank?

- Trust

- Expertise; Sygnum is the world’s first digital asset bank, licensed by FINMA (Swiss Financial Market Supervisory Authority).

Why Switzerland?

- Switzerland is a pioneer and an early adopter of DLT (Distributed Ledger Technology) regulations, making it one of the few jurisdictions that recognize securities natively issued on a blockchain.

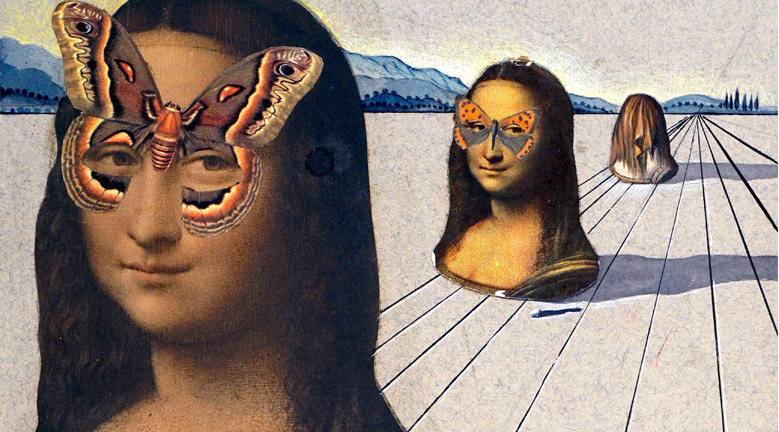

SALVADOR DALÍ (Spanish, 1904 - 1989)

End, 1952

Salvador Dalí remains a towering figure in 20th-century art, known as one of the most prominent, recognizable, and acclaimed names of Surrealism. The work End is the complement to Hidden Faces, the cover that Dalí created including the Mona Lisa, offered last year by Artemundi as a fractional investment opportunity. While Hidden Faces decorated the front of his only novel, Rostros Ocultos, End was intended to be the back cover and consequently the two works are connected artistically.

Centered around a meticulously rendered skull bearing the word “FiN” (“End” in Spanish), the artwork is an exploration of mortality and symbolism. Three wasps traverse the skull’s surface, adding an enigmatic touch to the composition, while a Catalan figure and crutch in vibrant hues enhance its visual impact.

Dalí’s works featuring skulls have consistently commanded high prices. With End being a newcomer to the market, having previously been held in private hands, its scarcity further boosts its appeal. Moreover, the artwork’s connection to Dalí’s only novel adds an extra layer of historical significance, potentially increasing its long-term value.

Artemundi and Splint Invest have partnered to offer European investors fractional ownership of this artwork starting at 50€. Investments can be made in Splint Invest’s app, where we kindly ask you to consult all the details about this opportunity.

Date of issuance: April 26, 2024, at 9 AM CEST

Investment Available Starting at 50€

Issuer: Spectrum Utilis with Artemundi as advisor

Custodian: Splint Invest

Investment Horizon: 1 – 3 years

Expected Return p. a. (1 – 3 years): 12-17%

Average Price Increase in Comparable Sales, Inflation Adjusted: 49%

Secondary Trade: Splint Invest’s app

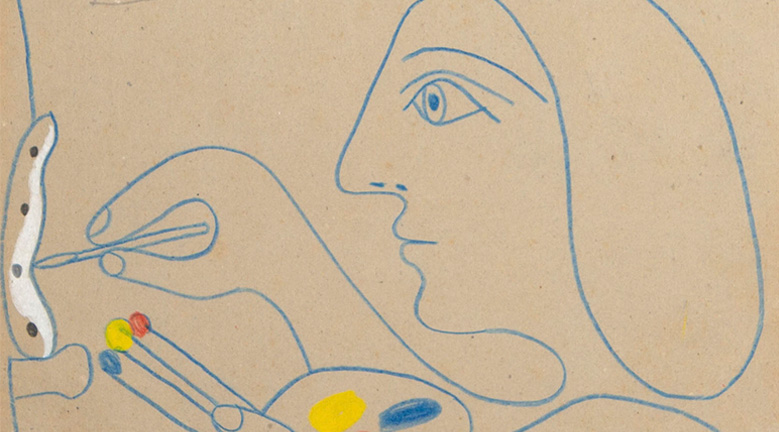

PABLO PICASSO (Spanish, 1881 - 1973)

The Painter III, 1970

This artwork offers a glimpse into Picasso’s creative process, depicting himself fully immersed in his craft. Notably, this artwork is the counterpart to The Painter II, which we previously offered as a fractional investment opportunity. Following its sell-out success, The Painter III now offers investors a second chance to co-own a Picasso through fractional ownership.

Pablo Picasso’s significance transcends mere artistic acclaim, making his works highly sought-after alternative assets for investment portfolios. Pieces such as those directly drawn on paper or cardboard demonstrate the immediacy of Picasso’s experimentation. Over the last decade, these works have consistently commanded prices exceeding $400,000, with a notable upward trend and favorable high-estimate-to-sale price ratios. Picasso’s solid market dominance is evidenced by his frequent inclusion in the Top 10 selling lots at major auction events annually, solidifying his status as a valuable addition to any investment portfolio.

Artemundi and Splint Invest have partnered to offer European investors fractional ownership of this artwork starting at 50€. Investments can be made in Splint Invest’s app, where we kindly ask you to consult all the details about this opportunity.

Date of issuance: April 5, 2024, at 9 AM CEST

Investment Available Starting at 50€

Issuer: Spectrum Utilis with Artemundi as advisor

Custodian: Splint Invest

Investment Horizon: 2 – 4 years

Expected Return p. a. (2 – 4 years): 12-18%

Average Price Increase in Comparable Sales, Inflation Adjusted: 14%

Secondary Trade: Splint Invest’s app

Exit Fee: 2%

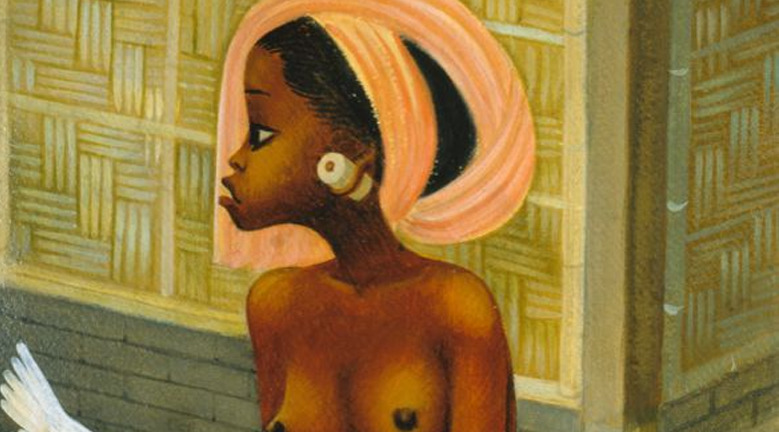

MIGUEL COVARRUBIAS (Mexican, 1904 - 1957)

Joven Balinesa, c. 1931

This artwork portrays a scene featuring a Balinese girl amidst her traditional habitat, accompanied by a hen. With delicate hands resting on her knees and an alert expression, she embodies the essence of rural life in Bali. Covarrubias, a contemporary of Salvador Dali and a friend to prominent artists like Frida Kahlo and Diego Rivera, dedicated a significant portion of his work to capturing Balinese traditions, showcasing his passion for ethnology.

Covarrubias’s depictions of traditional scenes consistently garner market appreciation, with prices often surpassing high estimates. Notably, this artwork holds significant investment potential, boasting a market valuation well above its purchase price. Additionally, its connection to the Nickolas Muray collection adds further allure.

Over the past seven years, comparable artworks have seen a steady increase in prices at auction, with a remarkable 23% average sale-to-sale growth, adjusted for inflation. This trend, coupled with the consistent performance of such works above high estimates, underscores the investment viability of Covarrubias’s pieces within the art market.

Artemundi and Splint Invest have partnered to offer European investors fractional ownership of this artwork starting at 50€. Investments can be made in Splint Invest’s app, where we kindly ask you to consult all the details about this opportunity.

Date of issuance: 15 March 2024, at 9 AM CET

Investment Available Starting at 50€

Issuer: Spectrum Utilis with Artemundi as advisor

Custodian: Splint Invest

Investment Horizon: 1 – 3 years

Expected Return p.a. (1 – 3 years): 13% – 19%

Average Price Increase in Comparable Sales, Inflation Adjusted: 23%

Secondary Trade: Splint Invest’s app

Exit Fee: 2%

((SOLD OUT))

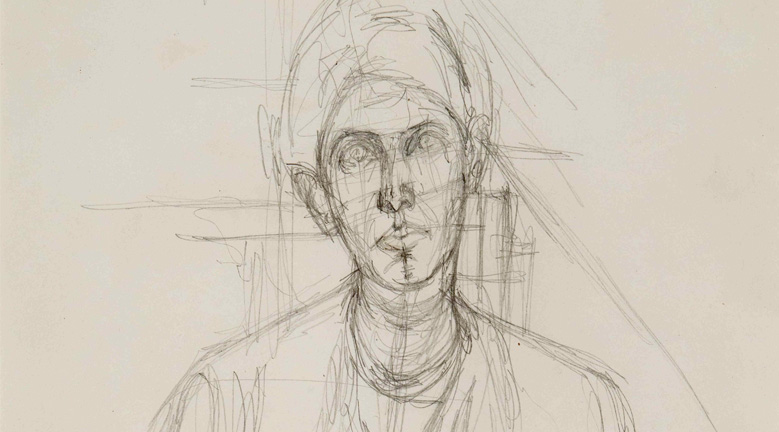

ALBERTO GIACOMETTI (Swiss, 1901-1966)

Portrait of Soshana, 1958

Alberto Giacometti’s Portrait of Soshana delicately captures the essence of his dear friend and fellow artist, Soshana Afroyim (1927-2015). Rendered in pencil, Soshana’s serene countenance engages viewers as she sits with hands gracefully crossed, evoking a sense of intimacy and depth. The portrait stands as a testament to the bond between the two artists, reflecting Giacometti’s profound ability to capture the essence of his subjects with subtle yet deep detail. Giacometti, the most important Swiss artist of the 20th century and a leading figure of Modernism, imbues his work with a timeless quality that continues to fascinate audiences worldwide.

In the art market, Giacometti’s works have experienced an exceptional surge in demand and value. Over the past decade, the global Giacometti market has more than doubled, with a turnover surpassing USD 64 million in 2023 alone. Notably, Giacometti’s market performance ranks him among the top 12 best-selling artists by value.

Artemundi and Splint Invest have partnered to offer European investors fractional ownership of this artwork starting at 50. Investments can be made in Splint Invest’s app, where we kindly ask you to consult all the details about this opportunity.

Date of issuance: February 16, 2024, at 9 AM CEST

Investment Available Starting at 50€

Issuer: Spectrum Utilis with Artemundi as advisor

Custodian: Splint Invest

Investment Horizon: 2 – 4 years

Expected Return p.a. (2 – 4 years): 11-18%

Average Price Increase in Comparable Sales, Inflation Adjusted: 16%

Secondary Trade: Splint Invest’s app

Exit Fee: 2%

((SOLD OUT))

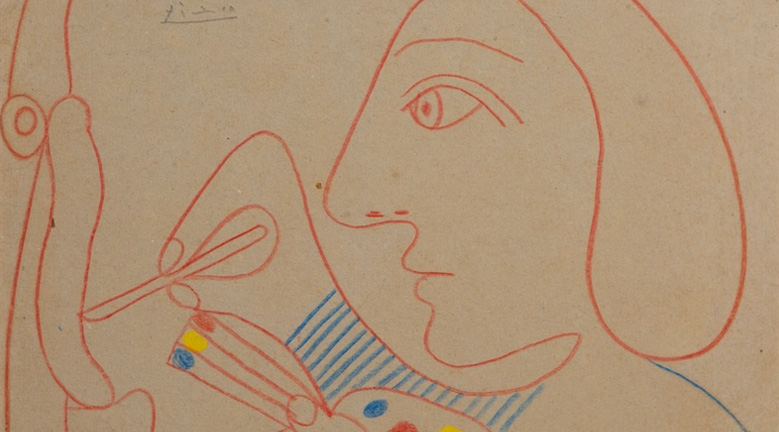

PABLO PICASSO (Spanish, 1881 - 1973)

The Painter II, 1970

This self-portrait from Picasso’s later years exemplifies the artist’s commitment to his craft. Executed with meticulous colored crayon strokes in red, yellow, and blue, the composition reveals a rejuvenated spirit and focused dedication. Picasso dedicated well over 500 works to painting artists at work, including himself. Especially in 1970, he repeatedly returned to the theme and created various versions of a painter seen in profile handling his color palette, pencil, or brush.

This is a unique opportunity for anyone to invest in today’s top world-selling artist, Picasso, who hasn’t left the top 3 positions in the art market ranking for a decade. The value of paintings and works on paper from his final years outperforms their market volume. In 2023, Picasso’s works on paper generated over USD 32.5 million: more than many other artists markets all categories combined.

Artemundi and Splint Invest have partnered to offer European investors fractional ownership of this artwork starting at 50. Investments can be made in Splint Invest’s app, where we kindly ask you to consult all the details about this opportunity.

Date of issuance: January 25, 2024, at 6 PM CEST

Investment Available Starting at 50€

Issuer: Spectrum Utilis with Artemundi as advisor

Custodian: Splint Invest

Investment Horizon: 2 – 4 years

Expected Return p.a. (2 – 4 years): 11-15%

Average Price Increase in Comparable Sales, Inflation Adjusted: 14%

Secondary Trade: Splint Invest’s app

Exit Fee: 2%

((SOLD OUT))

MARC CHAGALL (Belorussian, 1887 - 1985)

The Sleep of Love, 1956-57

In The Sleep of Love, Marc Chagall poignantly captures themes of love and loss intertwined with familial bonds. Chagall’s artistic muse was his wife, Bella Rosenfeld. Her 1944 passing left Chagall with their only daughter, Ida, forging a deep father-daughter connection. Settling in France in 1948, the artist continued to convey his emotions until his 1985 death.

The painting depicts a tender moment as Bella, absent in physical form, cradles a grown-up Ida. Chagall’s masterful use of color is evident in the dominant signature blue symbolizing tranquility. The inclusion of green introduces nostalgia, representing the tension between change and continuity in life’s spiritual aspects. Dark outlines emphasize the loving relationship between the figures. The initial impact of vivid blue gives way to a touching portrayal of love, loss, and for what once was, encapsulating the emotions that Chagall so skillfully conveyed in this artwork.

Chagall’s art market stands resilient and predictably grows, offering a stable investment in uncertain times. With enduring appeal, it presents a low-risk profile.

In February 2024, before the end of the investment horizon of 2 to 4 years, an interested buyer presented an unsolicited offer for the artwork that outperformed the ambitious investment scenario (11%) and surpassed the artwork’s predicted two-year value increase after only 1.5 months. In line with the majority of co-owners, the offer was accepted, and the investment was successfully exited.

This exited investment opportunity shines with a remarkable realised profit 15.4% after accounting for fees, resulting in an impressive annualised return of 136%. During the same period, the S&P 500 recorded a value increase of 5%, while traditional stock indices such as the SMI and Gold experienced slightly lower value increases with 1.1% and 0.5%, respectively.

Released: December, 2023

Investment exit: February, 2024

Holding period: 1.5 months

Realized ROI (net of all fees) : 15.4%

Expected return: 7 – 11% p.a.

Annualized return: 136%

((EXITED INVESTMENT))

SALVADOR DALÍ (Spanish, 1904 - 1989)

Hidden Faces, 1952

Hidden Faces has been in only one private collection before being bought for fractionalization and is entirely new to the market, which generally positively affects the price. At the time, Dalí made it to the cover of the only novel he ever wrote, Rostros Ocultos (Hidden Faces), which in his home country, Spain, was censored: thirty pages of eroticism did not make it to print. They only saw the light in France, England, and the United States.

One of the most important figures of Surrealism, the unique style of Spanish artist Salvador Dalí is almost synonymous with the art movement he shaped so much. Although one of the most recognizable artists of our times, the Dalí market remains more accessible when compared with other top-level artists. In the last two decades, the total turnover of all artworks sold at auction by the artist surpassed USD 400 million, of which a fourth was paid for works on paper, a remarkable percentage compared to other high-ranking artists.

Artemundi and Splint Invest have partnered to offer European investors fractional ownership of this artwork starting at 50€. Investments can be made in Splint Invest’s app, where we kindly ask you to consult all the details about this opportunity.

Date of issuance: November 30, 2023, at 6 PM CEST

Investment Available Starting at 50€

Issuer: Spectrum Utilis with Artemundi as advisor

Custodian: Splint Invest

Investment Horizon: 2 – 4 years

Expected Return p.a. (2 – 4 years): 9% – 15%

Average Price Increase in Comparable Sales, Inflation Adjusted: 74%

Secondary Trade: Splint Invest’s app

Exit Fee: 2%

((SOLD OUT))

MIGUEL COVARRUBIAS (Mexican, 1904 - 1957)

Juchitecos Dancing the Son, 1942

In this cheerful work, Miguel Covarrubias captured a quintessentially Mexican scene: the so-called Juchitecos Dancing the Son, a traditional dance still popular today and emblematic of the culture of Juchitan.

Miguel Covarrubias was an artist and intellectual who lastingly influenced American art and promoted Mexican culture beyond its borders, since he worked from his home country and later moved to the USA. Today, his work is recognized alongside the artistic contributions of Frida Kahlo, Diego Rivera, and other key-figures of 20th century Mexican art.

The Covarrubias market has particularly increased since 2011 and its index grew by around 170% points, outperforming the index of art market greats such as Pablo Picasso and Claude Monet during the respective period.

Artemundi and Splint Invest have partnered to offer European investors can purchase fractional ownership of this artwork starting at 50€, and you can use the code ARTEMUNDIMC to get a 50€ welcome bonus (new users only). Investments can be made in Splint Invest’s app, where we kindly ask you to consult all the details about this opportunity.

Date of issuance: October 26, 2023, at 6 PM CEST

Investment Available Starting at 50€

Issuer: Spectrum Utilis with Artemundi as advisor

Custodian: Splint Invest

Investment Horizon: 2 – 4 years

Expected Return p.a. (2 – 4 years): 12% – 18%

Average Price Increase in Comparable Sales, Inflation Adjusted: 31%

Secondary Trade: Splint Invest’s app

Exit Fee: 2%

((SOLD OUT))

SALVADOR DALÍ (Spanish, 1904 - 1989)

The Mill Tower, 1977

The Mill Tower is a collage of Salvador Dalí’s later years, executed in 1977. It is exemplary of Dalí’s experimentation with three-dimensionality, his ambition to bend possibilities and to turn the tower of six intertwined seagull heads into a tangible object.

One of the most important figures of Surrealism, the unique style of Spanish artist Salvador Dalí is almost synonymous with the art movement he shaped so much. Coherent yet truly unique are each of his artworks and especially the finely executed artworks enjoy a lasting stable position in the art market. In the last two decades, the total turnover of all artworks sold at auction by the artist reached almost USD 400 millions of which a fourth were paid for works on paper such as collages, drawings, and watercolors.

Artemundi and Splint Invest have partnered to offer fractional ownership of this artwork in European countries, starting at 50€, through Splint Invest’s app.

Date of issuance: September 28, 2023

Investment Available Starting at 50€

Issuer: Spectrum Utilis with Artemundi as advisor

Custodian: Splint Invest

Investment Horizon: 2 – 4 years

Expected return p.a.: 10% – 14%

Average Price Increase in Comparable Sales: 29%

Secondary Trade: Splint Invest’s app

Exit Fee: 2%

((SOLD OUT))

JOAN MITCHELL (American, 1925 - 1992)

Untitled, ca. 1962

Joan Mitchell’s Untitled from ca. 1962, painted shortly after settling in France, presents a vivid composition with brushstrokes intensifying and culminating in the centre of the canvas. The artist united dark blues and greens with red tones on a bright ground of whites, which is prominent on the outer edges and especially the lower part of the painting.

Following the increasing abstraction that had entered her style since her French adventure, Mitchell became an active participant in the “New York School”. In 1951, the artist exhibited among other representatives of the group in the famous “9th Street Show” organized by Leo Castelli and was able to establish herself as an important figure of the male dominated world of Abstract Expressionism.

Mitchell’s mid-century paintings may be her most sought-after. Today Mitchell is one of the most valuable woman artist alongside Frida Kahlo, Georgia O’Keeffe, Agnes Martin and Artemisia Gentileschi.

Joan Mitchell has ascended to an art market titan.

Similar paintings to Untitled can be found in museum collections around the world. The Mitchell-Monet retrospective and survey at Foundation Louis Vuitton, San Francisco Museum of Modern Art (SFMOMA) and Baltimore Museum of Art (BAM), is one unprecedented dialogue between the works of two exceptional artists.

ANDY WARHOL (American, 1928 - 1987)

Four Marilyns, 1979-86

Paintings depicting Marilyn Monroe, while being scarcely 3% of the paintings by Warhol sold at auction since 2000, represent 17% of the total turnover. It is remarkable that works depicting Marilyn are constantly outperforming Warhol’s overall market index, Warhol’s paintings only index as well as the Artprice Global Index, by far. Further, all black and white versions offered at auction throughout history were sold, an impressive 0% BI (bought-in) ratio.

((SUBSCRIPTION CLOSED))

PABLO PICASSO (Spanish, 1881 - 1973)

Fillette au Béret, 1964

Fillette au béret (1964) stands out as a rare gem in Pablo Picasso’s mid-1960s portraiture. This singular piece, painted in 1964, is part of a trio of canvases and holds unique significance as an exploration of feminine representation. Believed to draw inspiration from Picasso’s own daughter, this painting showcases the artist’s exceptional ability to convey distinct personalities with minimal yet powerful brushstrokes. The vibrant color palette of green, red, black, yellow, and blue adds an intense and fulfilling dimension to this portrayal, reflecting a significant and poignant phase in Picasso’s artistic journey.

Picassos have a proven track record for continual appreciation in value, and Fillette au béret has been subject to Artemundi’s rigorous examination, which is based on more than 30 years of experience in art investment.

Date of issuance: October 2021

Tokens issued: 100%

Issuer: Spectrum Utilis, S.L.

AST symbol: PIC1

Custodian: Sygnum Bank

ISIN number: CH8301001400

Life cycle: 96 months

Trade: SygnEx exchange (closed)

((EXITED INVESTMENT))

Total investment time at exit (years): 1.4

Annualized ROI, net of all fees and expenses*: 15%

*Results may vary between initial token holders and others purchasing their units via the bank’s exchange (SygnEx) at different intervals and their respective pro-rata share of the administrative expenses.