The significance of art, does not negate its significant value and viceversa.

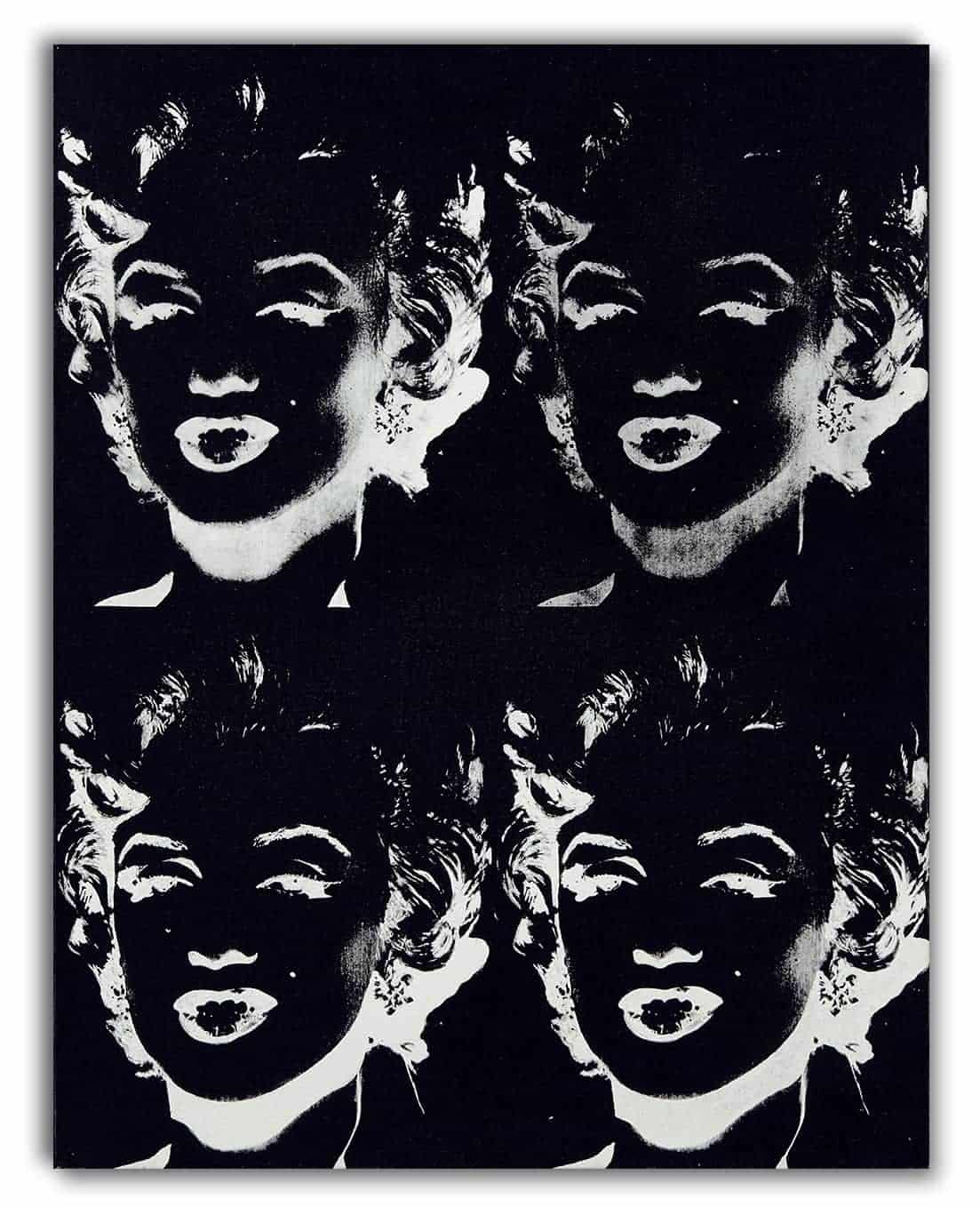

– Andy Warhol

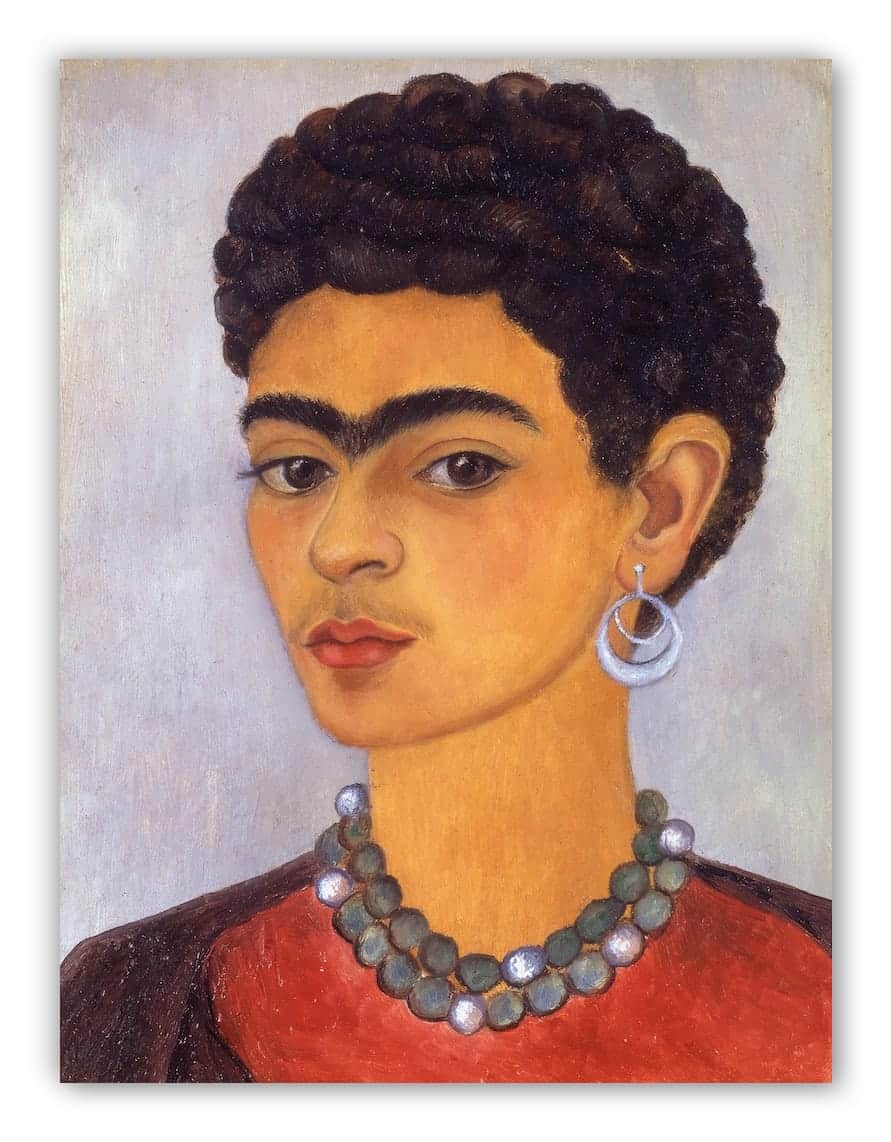

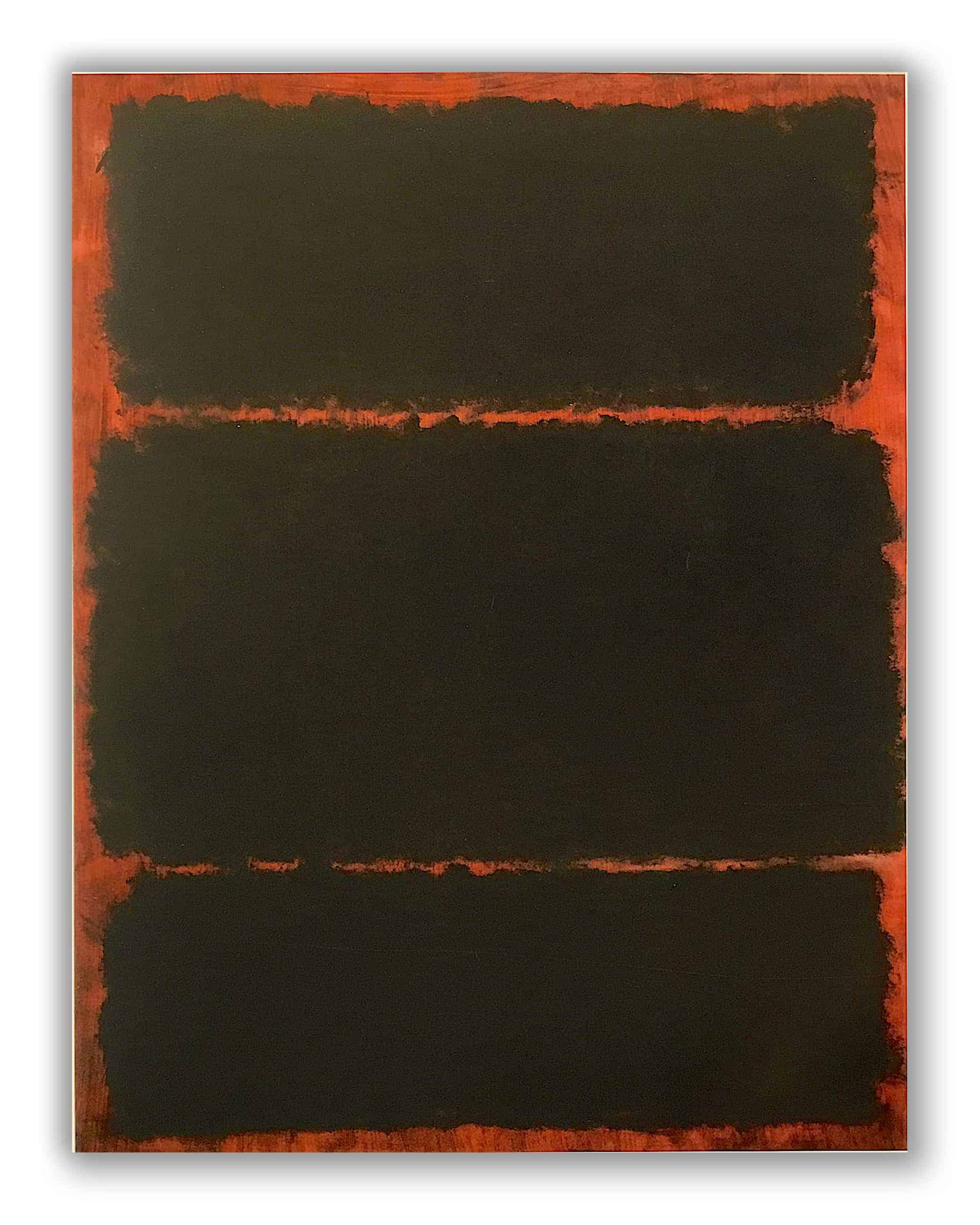

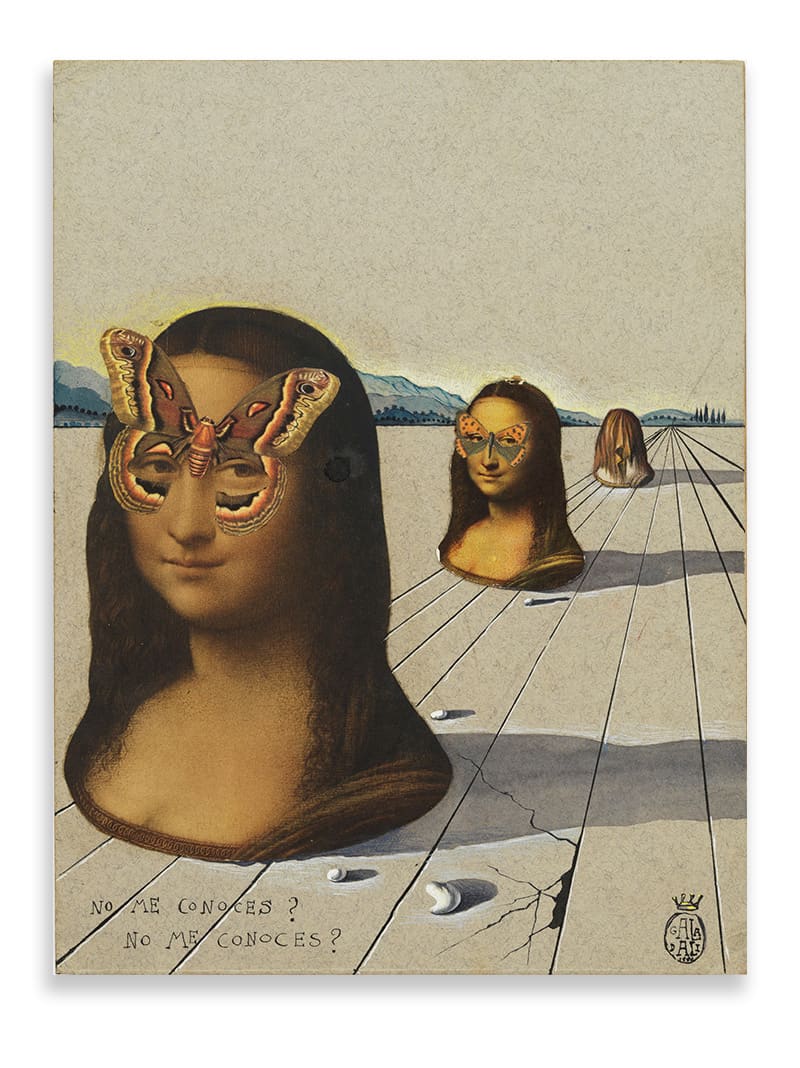

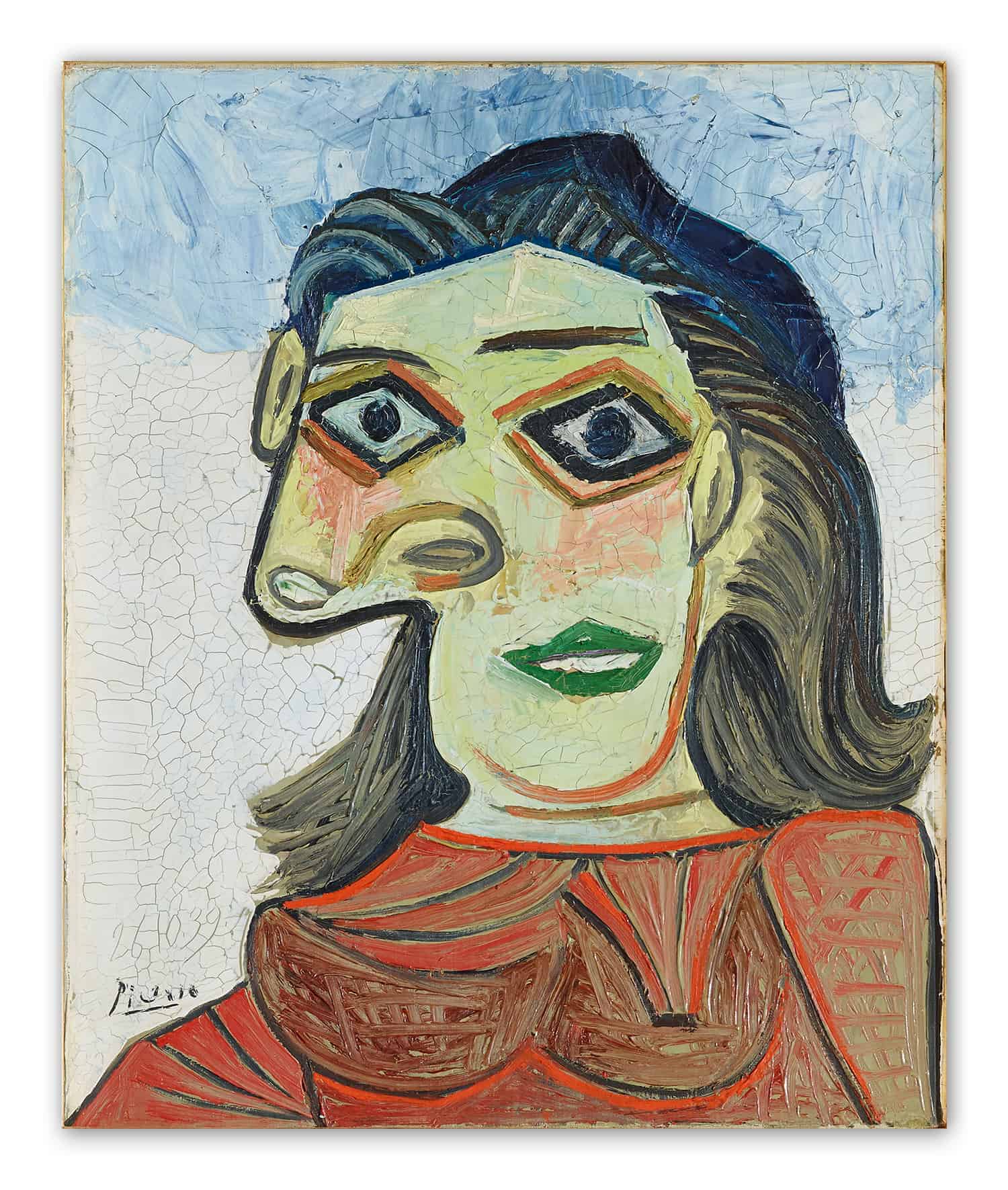

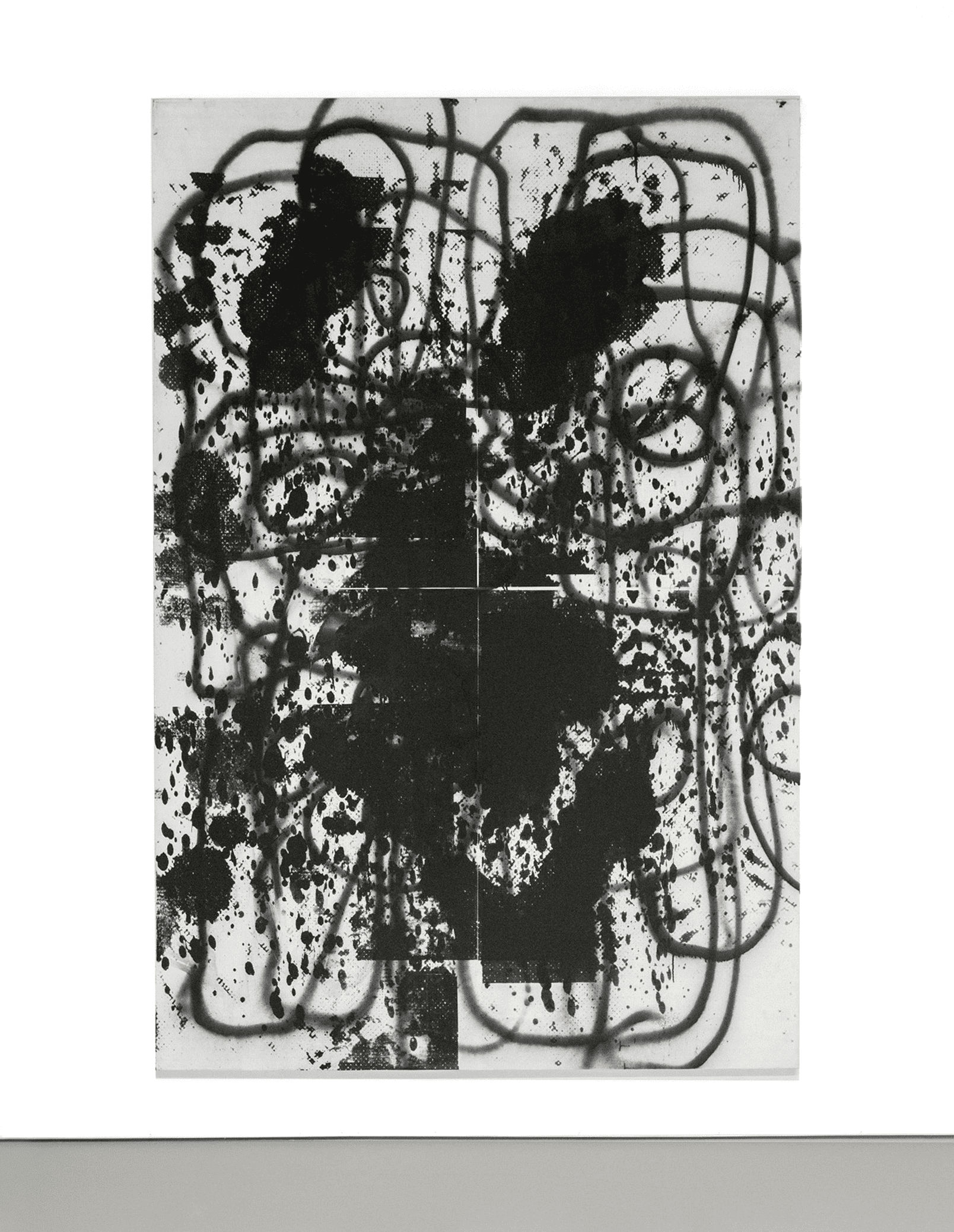

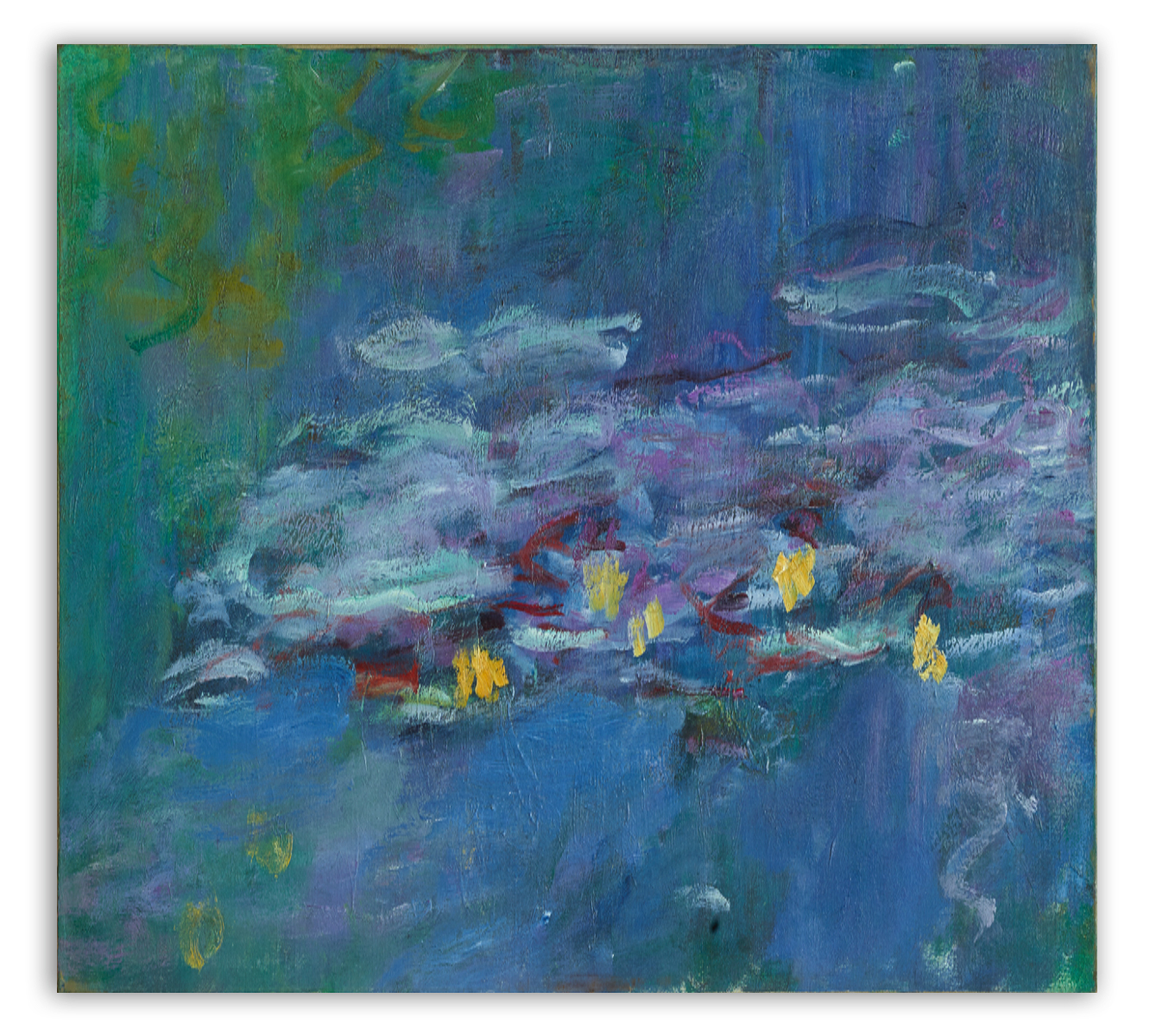

Artemundi was born out of a rebellious idea and a principled objective: to help our clients build and diversify their art investments without the excessive fees associated with traditional brick-and-mortar art companies while adhering to transparent business practices. We specialize in art investments with expertise in Impressionist, Modern, Post-War and late XX century historical artworks, deliberately excluding contemporary emerging art for investment purposes.

Since our foundation in 1989, Artemundi has evolved into an industry-leading art investment company with thousands of successful transactions and over a billion dollars managed in art. We have a successful track record providing expert art fund management, and other services. In addition, we have pioneered on a global scale the adoption of technology to create new investment opportunities through blockchain and art securitization.

We know that art is a real and tangible asset that appreciates over time in addition to its priceless emotional, intellectual, and cultural value.

Dedicated expertise

Decades of experience and our successful track record set us apart as the only art investment management company with a tested methodology.

We achieve attractive rates of return for investors looking to diversify holdings into tangible assets with performance unrelated to the capital markets.

Rebels by nature

Since 1989, we have grown contrary to traditional brick-and-mortar art businesses that carry huge overheads and excessive fees and commissions often on both ends.

Our track record

Artemundi Global Fund (2010-2015).

For more information about Artemundi Global Fund click HERE.

US$220,356,012.00

Accumulated assets under management

US$500 per share

Book value (initial)

US$983.55 per share

Book value (final)

Gross return (5 years): 96.71%

Net return (5 years): 85.36%

IRR: 17.41%

From 2016 to 2019, our own and related art investment portfolio was around US$100 million AUM per annum. Artemundi produced an average EBITDA over sales of 18.8% during that same period.

From 2020 to the present, we have engaged in launching new products focused on efficiency and new technologies.

Check our products and services to know their specific performance.

*Performance data displayed herein is historical, is not indicative of future returns and is no guarantee of future results. Information contained in this web-page is not intended to be used to assist the reader in determining artists or artworks to buy or sell or when to buy or sell such artists or artworks.

Our team

A team with experience & vision.

Our diverse team is integrated by international professionals, art collectors, specialists, and enthusiasts from the United States, Europe, United Kingdom, Mexico, Switzerland, and Brazil, unified by their deep artistic knowledge and their professional dedication towards delivering excellence in the art world.

Javier Lumbreras

Karla Torres

Almudena Mulas

Natascha Reihl

Sofía Fernández

Aldones Nino

Teamplayers and specialists

Grace Lumbreras

Marina Cochrane

Enrique Liberman

Sandra P. Kayal

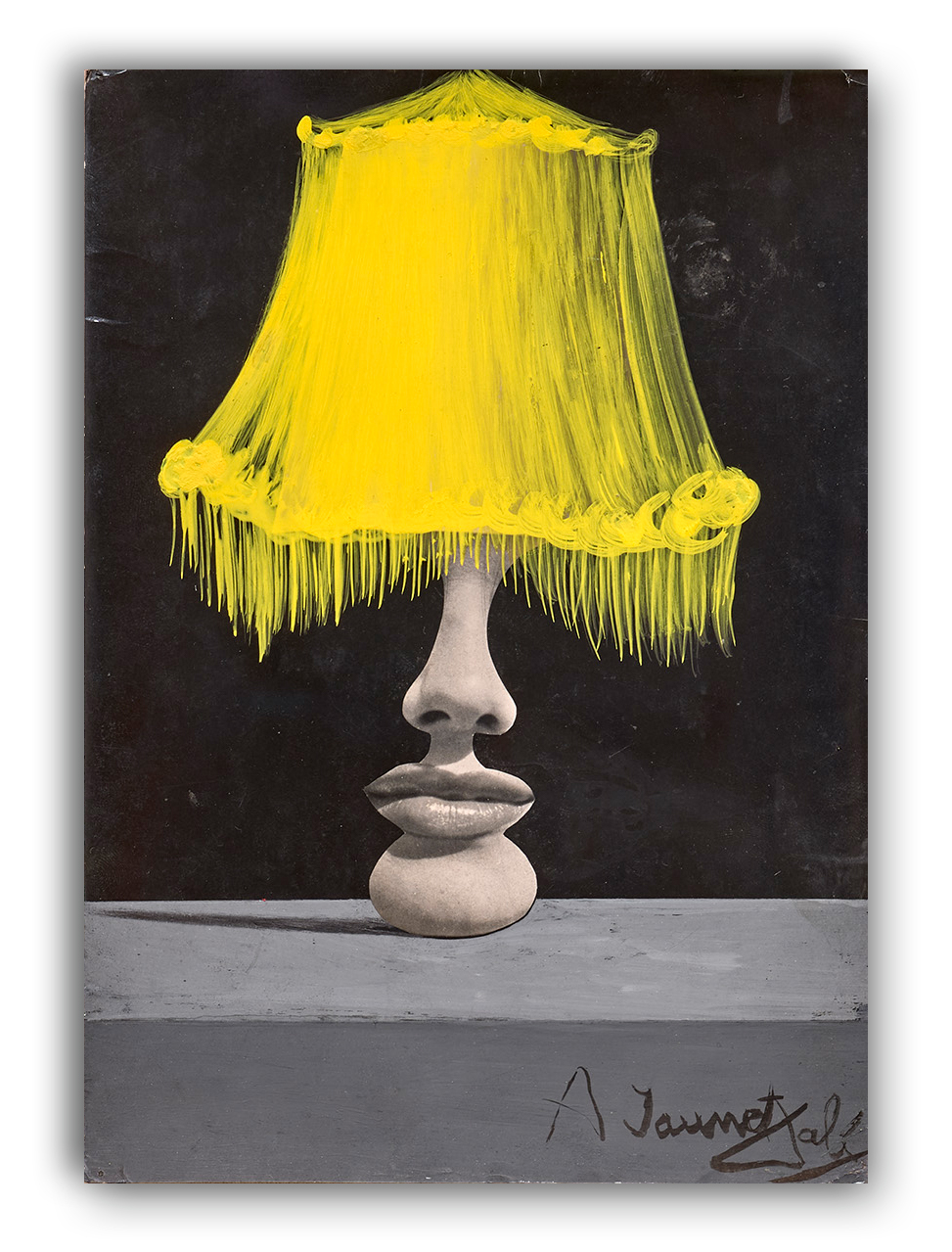

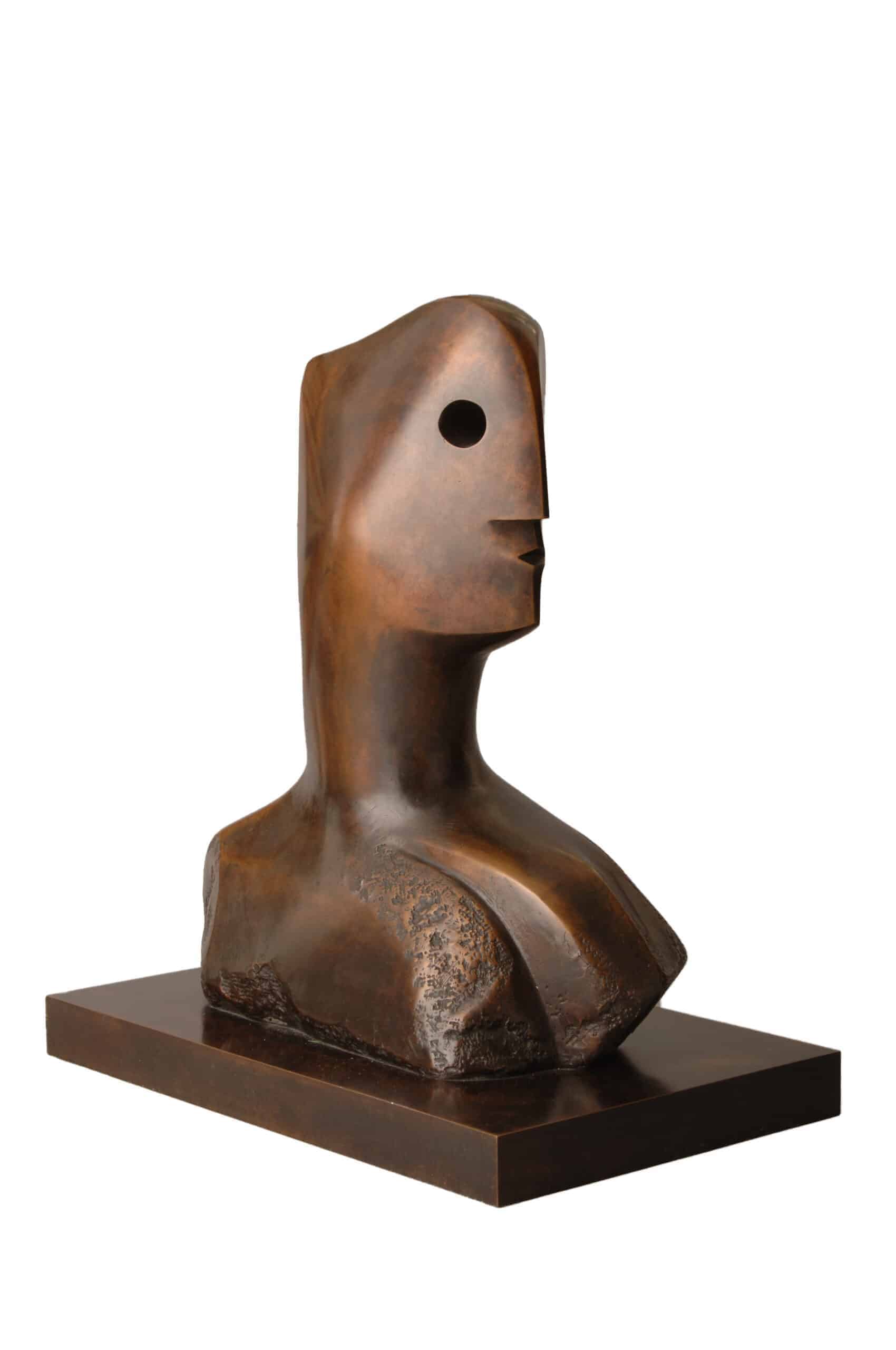

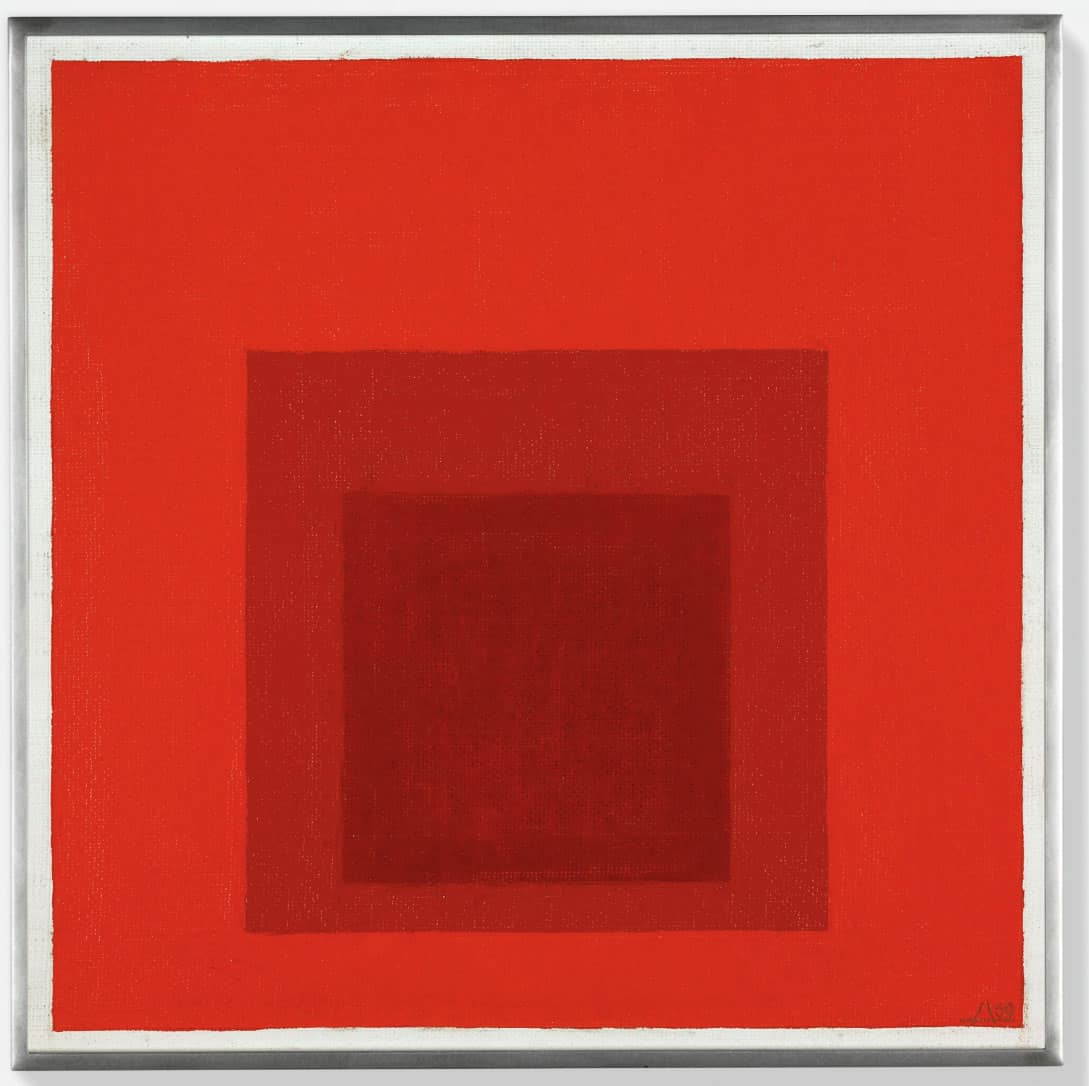

Our Artworks

Our partners

Artemundi has substantially invested in building up our reputation throughout an extensive network amongst the best art professionals.

From recognized databases to insurance companies, our strategic relationships with prominent art market specialists include key senior personnel to ensure that our art portfolio is managed with due diligence and proficiency.

![]()